Harbor Power: How China’s Autonomous Ports Have Left the U.S. Behind. America's Harbors Must Embrace Automation

China now operates 18 fully automated port terminals, with 27 more on the way while the U.S. didn't even make it into the top 25 most efficient ports in the world.

In the dead of night, the Port of Shanghai hums with a symphony of robotic cranes and autonomous vehicles, tirelessly loading and unloading cargo with surgical precision. Thousands of miles away, at major American ports like Los Angeles and Long Beach, workers grapple with congestion, delays, and an aging infrastructure that relies heavily on manual labor. Recent data and striking footage have laid bare a stark reality: China has outpaced the United States in the automation of its shipping ports, and the repercussions for American trade and economic competitiveness are profound.

The contrast is not just about technological showmanship; it's about efficiency, cost-effectiveness, and the future of global trade dominance. America’s path to economic robustness, resilience hangs in the balance.

Meanwhile, China's top ports have embraced state-of-the-art autonomous systems that streamline operations, reduce human error, and significantly cut turnaround times. According to recent reports, China now operates 18 fully automated port terminals, with 27 more on the way. These intelligent ports are not just about speed; they are about independence. China has also built its entire system without relying on foreign technology (South China Morning Post). This is not just an industrial revolution; it is a geopolitical masterstroke. According to a report by the World Bank and S&P Global Market, four of the world's top ten most efficient ports are in China. Meanwhile, no U.S. port made it into the top 25.

Key Insights:

Six of the top ten ports are in China: Yangshan, Ningbo-Zhoushan, Guangzhou, Shanghai, and Tianjin.

No U.S. port made it into the top 25 according to this report.

The largest ports in LA and Long Beach are ranked 376 and 378 on a list of 405 ports globally in efficiency.

The Numbers are Stark and Embarassing

Seeing the US ranked below ports in Africa is simply unacceptable and this efficiency gap has tangible compounding consequences. American consumers and businesses are already feeling the pinch from supply chain bottlenecks exacerbated by the COVID-19 pandemic. Delays at ports lead to increased shipping costs, which are inevitably passed down to consumers. In a world where time is money, the sluggish pace of American ports is costing us dearly.

Perhaps no two nations illustrate the chasm between the future and the past in port management better than the United States and China. China, with its sleek, autonomous ports, where robots whisk containers with precision and speed, stands in sharp contrast to the lumbering, labor-heavy docks of the United States, where modernization is slower, bogged down by bureaucracy, labor concerns, and underinvestment. In this competition, China is pulling ahead, leaving the U.S. scrambling to catch up.

A Tale of Two Ports

Consider the case of Shanghai and Los Angeles—two ports representing the forefront of each nation’s shipping power. In 2023, the Port of Shanghai handled over 47 million twenty-foot equivalent units (TEUs), maintaining its position as the world’s busiest container port. Meanwhile, the Port of Los Angeles, the busiest in the U.S., processed just 10 million TEUs—a quarter of its Chinese counterpart.

The difference is not just in scale, but in efficiency. Shanghai’s Yangshan Deepwater Port is a paragon of autonomy, with fully automated cranes and driverless trucks navigating the sprawling complex. Workers are few and far between. In contrast, Los Angeles relies heavily on human labor, with longshoremen overseeing the movement of containers—a system that, while traditional, is increasingly viewed as inefficient in today’s high-tech world.

"Ports today are the critical junctions in the global supply chain," says Peter de Langen, a principal consultant at Ports & Logistics Advisory in Spain. "China has recognized this and invested in automation and green energy at a scale the U.S. simply hasn’t matched for years."

The Race for Automation

The Chinese government’s strategic embrace of port autonomy is no accident. In 2017, President Xi Jinping underscored the importance of maritime infrastructure, stating that a nation "must first build ports" to ensure its place in global trade. The result is a comprehensive effort to turn Chinese ports into the most advanced in the world, capable of handling growing volumes of goods with decreasing manpower.

One of the most significant examples is the expansion of Tianjin Port, which, by 2022, had introduced fully autonomous trucks capable of operating 24/7, regardless of weather conditions. In addition, China's reliance on automated gantry cranes has slashed loading times, reduced labor costs, and minimized human error, pushing it far ahead in the race for efficiency.

“The level of automation we’re seeing in Chinese ports is simply staggering,” notes Dr. Wang Jian, a logistics expert at Tsinghua University. “They’ve managed to reduce unloading times by over 30%, while cutting operational costs by nearly 50% compared to traditional ports in the U.S.”

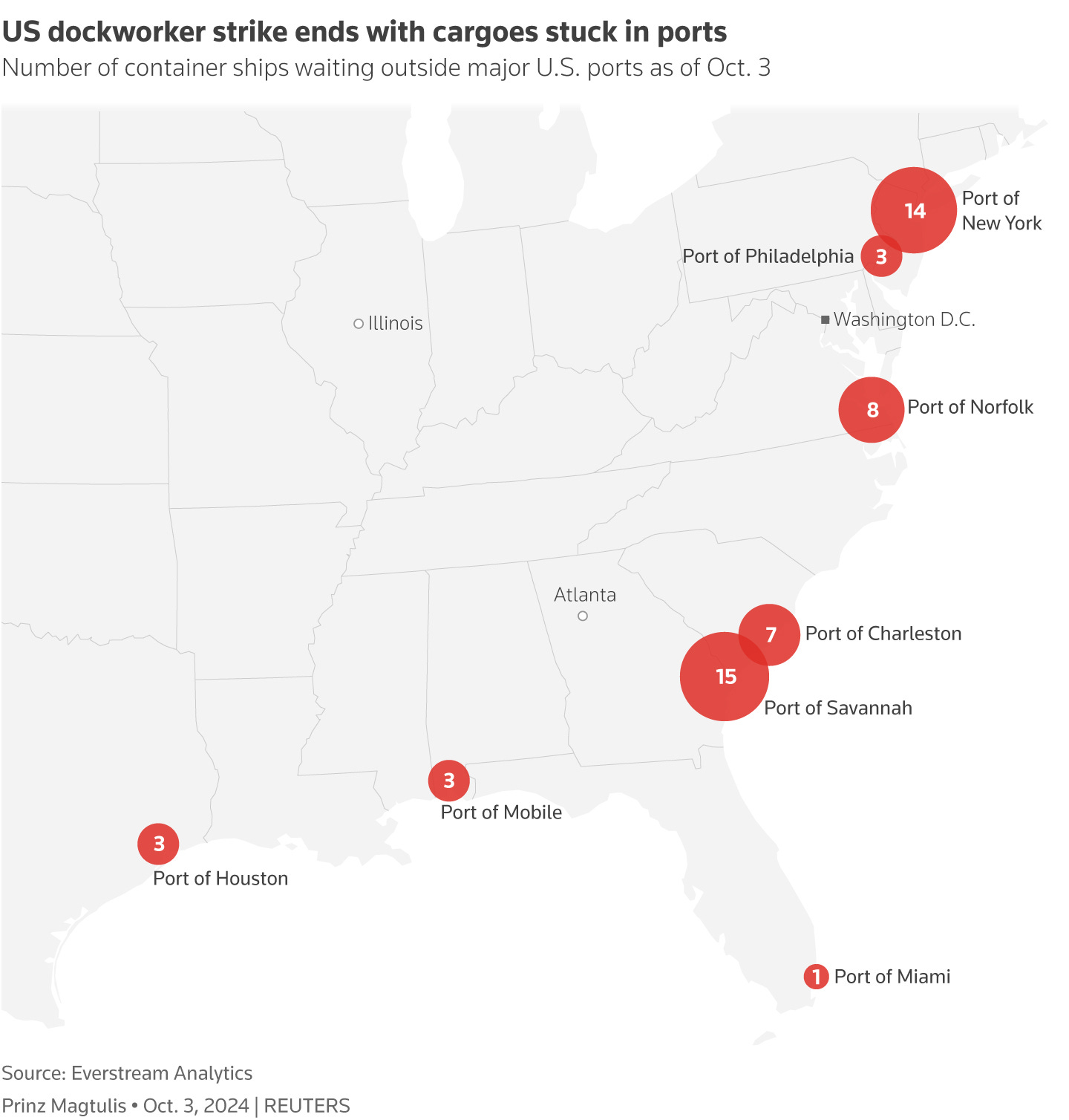

In contrast, American ports are hamstrung by a combination of labor disputes and an aversion to automation, particularly from powerful unions like the International Longshore and Warehouse Union (ILWU) led by Harold Daggett. I mean one only has to look at the events that transpired just this week to illuminate the current state of affiars. And if you want to learn a little more about who Harold Daggett is, and who we’re dealing with at the union, let’s just say he’s a piece of work.

The union's leadership fears that automation will lead to significant job losses, a sentiment that has led to strikes and labor unrest across U.S. ports. As a result, the transition to automation has been piecemeal at best.

The Impact on This Week’s Dockworker Strike

Anticipated Upgrades and Innovation

A 2023 report by the American Association of Port Authorities (AAPA) estimated that U.S. ports would need over $29 billion in infrastructure upgrades to remain competitive. Yet the political will to invest this kind of capital is lacking.

"There’s a deep reluctance to fully embrace automation here in the U.S.," says Roger Guenther, executive director of the Port of Houston. "We're caught between wanting to modernize and not wanting to eliminate jobs. But if we don't act soon, we’ll be left behind."

America Must Catch Up with China on Autonomous Shipping Ports—Before It’s Too Late

It is not just about trade or jobs, but the geopolitical leverage that ports provide. Chinese ports, responsible for handling nearly 30% of the world’s container shipping volume, are seen as pivotal assets in Beijing’s broader Belt and Road Initiative (BRI), which seeks to expand China’s influence through infrastructure investments across Asia, Africa, and Europe.

In many ways, the battle between U.S. and Chinese ports is a microcosm of the larger geopolitical struggle between the two superpowers. Ports, after all, are not just gateways for goods—they are symbols of national power and influence.

"The future of trade, and by extension the future of the global economy, will be determined by which nation can best adapt to the challenges of the 21st century," says economist Robert Lawrence. "Right now, China is winning that race."

As ships continue to sail across the world’s oceans, carrying the lifeblood of commerce, the ports they dock at will determine more than just the flow of goods—they will determine the balance of power in an increasingly competitive world. For the United States, the question is no longer whether to modernize, but whether it can do so quickly enough to stay in the game.

Embrace Innovation

While it takes a systematic approach to solve this problem: political will, talented people, local government support and more, truly solving the port automation crisis in America will ultimately be enabled and thus solved through technology. Here’s just sneak peak of the type of solutions we should be engaging with:

1. Sea Machines Robotics

Description: Sea Machines Robotics is a leader in pioneering autonomous control and advanced perception systems for the maritime industry. Their systems allow for the automation of commercial vessels and assist with vessel control, enhancing operational efficiency and safety in shipping ports.

Founders: Founded by Michael G. Johnson in 2015, who has a background in commercial maritime operations and naval architecture.

Funding: The company has raised significant venture funding, including from notable investors like Toyota AI Ventures and Accomplice VC.

2. Outrider

Description: Outrider focuses on automating yard operations in logistics hubs, including shipping ports. Their system automates the movement of trailers in and out of warehouses and shipping areas using electric yard trucks. Their tech helps with trailer hitching, backing, and trailer yard management through autonomous systems.

Founders: Founded by Andrew Smith in 2017, who previously founded a solar energy company and brings expertise in logistics and autonomous tech.

Funding: Outrider has raised over $200 million from investors like NEA, 8VC, and our friends at Koch Disruptive Technologies.

3. Vecna Robotics

Description: Vecna Robotics develops autonomous mobile robots that can be applied in various sectors, including logistics, warehousing, and port operations. Their robots help automate material handling tasks and trailer loading and unloading.

Founders: Founded by Daniel Theobald in 1998, a visionary in robotics and artificial intelligence with several patents in the field.

Funding: Vecna Robotics has secured venture backing from investors like Blackhorn Ventures, Drive Capital, and TDF Ventures.

4. Xenomatix

Description: Xenomatix specializes in LiDAR technology that supports autonomous vehicle systems for ports and logistics operations. Their technology enables vehicles to have better perception and environment understanding in challenging environments like shipping terminals.

Founders: Founded by Filip Geuens in 2013, who has a background in automotive and engineering technologies.

Funding: Xenomatix has received venture funding from investors including Capricorn Venture Partners and PMV.

6. Parallel Systems

Description: Parallel Systems is focused on revolutionizing freight transport by developing autonomous electric rail vehicles designed to move containers at lower costs and with reduced environmental impact. Their autonomous rail technology can significantly enhance the efficiency of shipping ports by automating the movement of cargo, enabling faster and more flexible freight transport. Parallel Systems is positioning itself as a key player in transforming port logistics by introducing autonomous rail as a flexible and scalable solution to container transport, complementing traditional truck and rail systems.

Founders: Matt Soule, John Howard, and Ben Stabler, all former SpaceX engineers, founded the company in 2020. Their deep expertise in electric propulsion, automation, and hardware engineering from their time at SpaceX has been a driving force behind Parallel Systems' development.

Funding: Parallel Systems has raised over $50 million in venture funding, including a $49.55 million Series A round led by investors such as Anthos Capital, Congruent Ventures, and Riot Ventures.

7. Glīd Technologies

Description: Glīd Technologies is transforming port and rail logistics with its patented autonomous road-to-rail vehicles, designed for seamless container and cargo movement. By automating material handling and increasing rail utilization, Glīd reduces costs, enhances safety, and lowers emissions. Eliminating the need for forklifts, cranes, and extra equipment, Glīd enables faster, more reliable freight transport. Its human-assisted autonomy approach also empowers marginalized port communities through education and training, preparing them for the future of logistics jobs.

Founders: Glīd Technologies was founded in 2022 by Kevin Damoa and Matt Mueller, both engineers. Kevin, a retired military veteran of the Army and Air Force, brings logistics expertise and ground support equipment design from SpaceX, Northrop Grumman, and XOS Trucks. Matt has worked at SpaceX, Honeywell, and Hadrian, driving Glīd’s technological innovations.

Funding: Glīd Technologies is closing a $5 million pre-seed round.

America's Harbors Must Embrace Automation

The battle for global trade supremacy is not just being fought in boardrooms or on Wall Street; it is being waged at ports across the world. China’s rise as the undisputed leader in port efficiency and autonomy is not just a testament to its technological prowess but a warning to the West. The time for the U.S. to modernize is now. If it fails, the cost may not just be economic—it may very well be geopolitical.